By Katie Winner (For The Win Communications, Ltd.)

At the B.O.L.D Policy Changes Forum, hosted by the Arvada Chamber of Commerce, veteran business reporter and current Colorado Chamber of Commerce Vice President Ed Sealover summed up the 74th General Assembly session as “one of the best 120 day sessions in a long time, if you just eliminate the first 110 days,” a comment that encapsulated the activity in the last weeks of the session where some bills made it across the finish line, new bills were introduced, and some died on the calendar.

Hosted at the new Arvada Chamber offices in Arvada, Sealover moderated a panel of experts in the areas of K-12 Education, Housing, and Child Care who shared their insight and observations on the 2024 legislative session highlighting the importance of bi-partisan policy-making, building internal relationships with elected officials, the need for policies that support a thriving local economy, and a glimpse ahead to the work to be continued in 2025.

K-12 Education Legislation

Kicking off the forum was Sarah Swanson, Director of Policy at Colorado Succeeds, a statewide business coalition dedicated to growing homegrown talent to thrive by focusing on legislation from Pre-Kindergarten through High School and beyond, who lead a review of four bills that came out of the work of the state legislature in 2024.

House Bill 24-1365: Opportunity Now Grants and Tax Credit

Sealover and Swanson were proud to talk about House Bill 1365, a piece of legislation worked on by both of their organizations. The bill aims to create pathways for Coloradans to get into fields of work that are open to students without a college degree but where employers are finding shortages of skilled talent. Highlighting the importance of creating accessible pathways to jobs, the bill establishes a series of summits to be held statewide to get the local business community directly involved in creating the homegrown talent pipeline in their communities with insights into what jobs are needed now and in the future.

House Bill 24-1448: New Public School Funding Formula

Described by Swanson as one of the “wonkiest bills,” and more contentious bills within the Democratic caucus, was the long-awaited revision of the Public School Finance Formula. House Bill 1448 created a new formula based on student needs by distributing funds to school districts based on student needs, providing more money for at-risk students, English learners, and those with special education needs, while also increasing funding for rural schools. The new formula will take effect in the 202-2026 school year and once fully implemented, will have added $500M into the system to benefit all students.

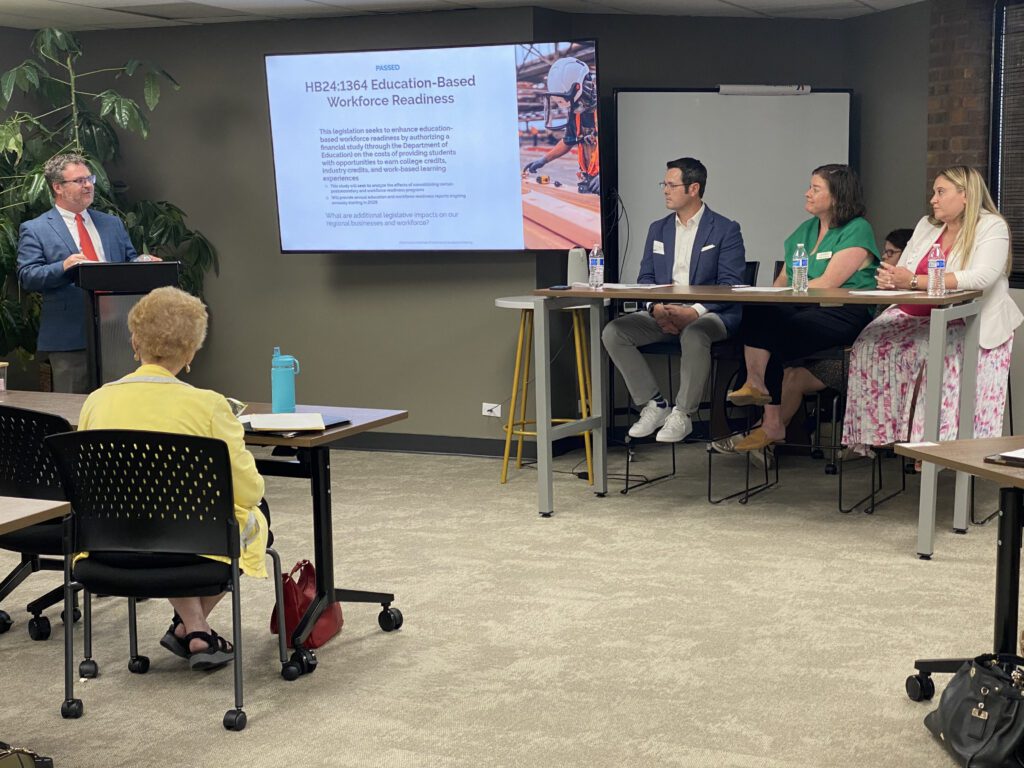

House Bill 24-1364: Education-Based Workforce Readiness

How do we know it’s working? House Bill 1364 is the first bill addressing the recommendations from the 1215 Task Force, which oriented around expanding career-connected learning opportunities for high school students. The bill lays the foundation for invested stakeholders, from policy makers to teachers to parents, to understand what is working when it comes to developing and implementing programs that support workforce development. The creation of a longitudinal data system will measure the long-term impacts of education and workforce development programs to see if these programs are serving the needs of students in diverse communities across Colorado and measure the direct impact to the workforce to bring more students into jobs and careers. The bill also creates a cost study to understand what it costs to provide college credit, industry credentials, and work-based learning experiences so that the state can responsibly expand these opportunities to more high school students.

House Bill 24-1439- Financial Incentives Expand Apprenticeship Programs

Colorado has embraced apprenticeship and work-based learning as a way to get both more students exposed to the workforce, and to get more businesses involved with students. Swanson noted that one thing that helps to create or expand apprenticeships is to offer incentives to get more businesses involved. House Bill 1439, run by the Colorado Department of Labor, will provide tax credits and grants to businesses that expand and develop apprenticeship programs. Swanson noted this bill will work well with House Bill 1365 and the forthcoming regional summits, providing education and resources directly to local businesses to create more work–based learning opportunities in their own communities.

Housing Legislation

Next up was Colorado Association of Homebuilders CEO Ted Leighty who noted that of the 705 bills introduced this session, 91 of those bills made his organization’s bill sheet to be tracked, taking positions and lobbying for or against 60 of those bills at the state capitol. Acknowledging some “bill fatigue,” Leighty noted that while there was some good bi-partisan work accomplished inside the state capitol, there is work to be done educating Coloradans on the true cost to produce affordable housing and the factors that have made housing so unaffordable in our state.

Senate Bill 24-233- Property Tax

You can’t start a conversation about housing without talking about property taxes. Introduced and passed in the final three days of the session, Senate Bill 233 was designed to alleviate the recent trend of spikes in property taxes from increased property values by giving taxpayers stability and a 5.5% cap without a massive backfill due to school districts and removing money from state-run programs.

Senate Bill 24-106- Right to Remedy Construction Defects

As the lone bill discussed at the form that did not pass this legislative session, Senate Bill 106 will be back. Last session’s highly contested Senate Bill 213 on Land Use provided the foundation and ideas that made Senate Bill 106 because, as said, “we need to address construction defect litigation.” Senate Bill 106 attempted to:

- Allow the Right to Remedy for a contractor to make repairs to construction before litigation.

- Increase the threshold for an HOA to sue from a simple majority vote to 60% of the residents and require a written notice to be provided to all HOA members about their rights once litigation commences.

- Reduce the severity and magnitude of claims of damage that produce no financial harm or are not code violations, such as the spacing of nails.

Leighty stated that Governor Jared Polis believes that something needs to happen, and when the bill comes back next year, Leighty is encouraged that a strong coalition of business and community members will step up to help pass this needed legislation.

Senate Bill 24-1152-Accessory Dwelling Units

While the City of Arvada has embraced Accessory Dwelling Units, otherwise known as ADUs, the concept of granny flats is not as widely practiced throughout the state and is outlawed in some municipalities. Not anymore. Senate Bill 1152 removes laws preventing the construction of an ADU, in 21 identified areas across the state within metropolitan planning organizations. “The housing deficit is so great, we need an all-of-the-above approach to affordable housing. We need more of every type of housing across the state,” said Leighty.

House Bill 24-1434-Expand Affordable Housing Tax Credit

A bill that made unusual bedfellows and drew accolades from developers, business groups and housing advocates alike was House Bill 1434. The bill tripled the annual allotment for the affordable housing tax credit with bipartisan backing from both chambers.

House Bill 24-1313- Housing in Transit-Oriented Communities

The child of Senate Bill 213, this session’s House Bill 1313 drew the attention of Arvada Mayor Lauren Simpson who encouraged a “no” vote during her first State of the City address earlier this spring. “Density is scary,” Leighty stated, noting that the bill now requires 31 local governments to change their laws allowing use-by-right for up to 40 acres aimed at increasing housing density near transit hubs. Leighty stated this bill “forced a conversation that needed to happen” that while it may change landscapes across Colorado, it has the great potential to increase a desperately needed housing supply.

House Bill 24-1316- Middle Income Housing Tax Credit

This aptly titled bill fills the gap of missing middle housing, defined as people earning 80 to 120% of the Area Median Income, or AMI. This bill provides resources and drives the Colorado Middle Income Housing Authority to work with community partners to find land and leverage funds to get housing projects off the ground and into the marketplace.

Childcare Legislation

Rounding out the forum was a conversation about childcare with Nicole Riehl, President and CEO of Executives Partnering to Invest in Children, otherwise known as EPIC. As a non-profit EPIC supports policies and workforce solutions for young children and their families powering childcare that fuels a healthy economy. With the cost of infant care in Colorado often reaching or surpassing $1800 for one child per month, and a shortage of 90,000 childcare slots, the lack of childcare continues to be a top need alongside the need for affordable housing.

House Bill 24-1237- Programs for the Development of Child Care Facilities

The two major issues facing child care are supply and affordability. This bill worked to address supply by taking three actions:

- Create a Childcare Facility Development Toolkit and technical assistance program to enable interested childcare providers, developers, employers, public schools, institutions of higher education, and local governments to understand the technical aspects of planning, developing, building, and co-locating child care facilities.

- Implement a grant program that incentivizes local governments to identify and make updates or improvements to community planning, development, building, and zoning, to support the development of childcare facilities.

- Develop a capital grant program to provide funds to build, remodel, renovate, or retrofit a childcare facility to meet the need for childcare in communities across Colorado.

House Bill 24-1311- Family Affordability Tax Credit

To address affordability of childcare, House Bill 1311 provides a tax credit of $3,200 per child to low- and middle-income taxpayers. The tax credit is only applicable when TABOR refunds are issued from the state. No TABOR refunds, no tax credit.

House Bill 24-1223- Improved Access to the Child Care Assistance Program

Another bill called a “wonky one,” Riehl explained that House Bill 1223 is aimed at helping to increase access to child care, which keeps workers in the workforce by making childcare more affordable. This is tied to the federally funded Child Care Assistance Program that has been revamped in recent years to implement consistent payment practices for providers and ensure they are paid at the going market rates.

Looking Ahead

To close, the panelists looked forward to discussing the issues we need to be talking about in 2025.

Sarah Swanson encouraged business leaders to listen to their employees and the issues that are impacting them. To move forward on education and more, Swanson encouraged more bi-partisanship and to encourage storytelling to legislators about the issues impacting their businesses and their employees’ lives.

Ted Leighty repeated the call for meaningful change to construction-defect laws as the root cause by which if successful, all other efforts to increase the supply of affordable housing will succeed. Leighty also encouraged the forum attendees to learn more about the process to build housing, and to be mindful of the impacts of legislation in our communities.

Nicole Riehl encouraged advocacy around how the state budget is allocated and promoted more tax policy for child care. Riehl also said more conversation will be had on modifying the child care contribution tax credit and the need to renew and restructure the tax credit next year while also looking at employer tax credits.

Finally, Ed Sealover advised forum participants to be on the lookout for pushback from both sides of the aisle as primary season begins, with voting starting the week of June 3 and election day on June 25th. Sealover noted several contested primaries of sitting legislators being challenged for their seats. Sealover encouraged potential voters to study the candidates on their ballot no matter which ballot they receive — and vote.

———–

Through the B.O.L.D. 2026 initiative, Advocacy KAPS Council, the Jefferson County Business Lobby (JCBL), and consistent outreach to elected officials at all levels of government, the Arvada Chamber strives to stay informed on the latest policy developments while advocating for a strong local economy. Find resources and ways to engage at arvadachamber.org/advocacy.

0 Comments